February 2022

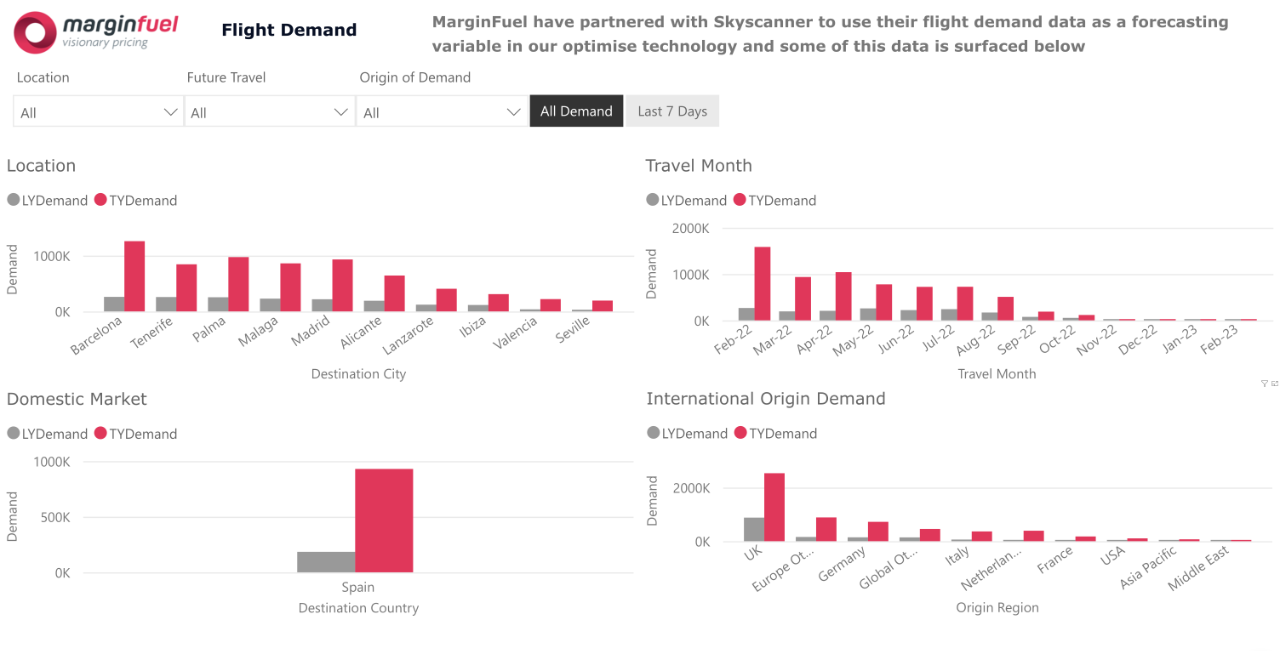

Easter holidays and summer 2022 are now the focus. Demand for Easter holidays far exceeds last year’s and therefore provides a great opportunity to yield.

Summer 2022 is showing very strong early demand – and as we all know, fleet will be limited so demand will outweigh capacity once again. Protect your summer by keeping your rates high and avoiding selling too cheaply too soon. Air demand into Spain is very strong, but we are still far away from the main booking period. Rates will only go up – as you saw last year.

With limited fleet and high demand, it will be critical to manage your fleet and channels accordingly. Make sure your fleet is at the right place and that you restrict booking coming from your less-contributing and less-profitable channels.

Fig. 1

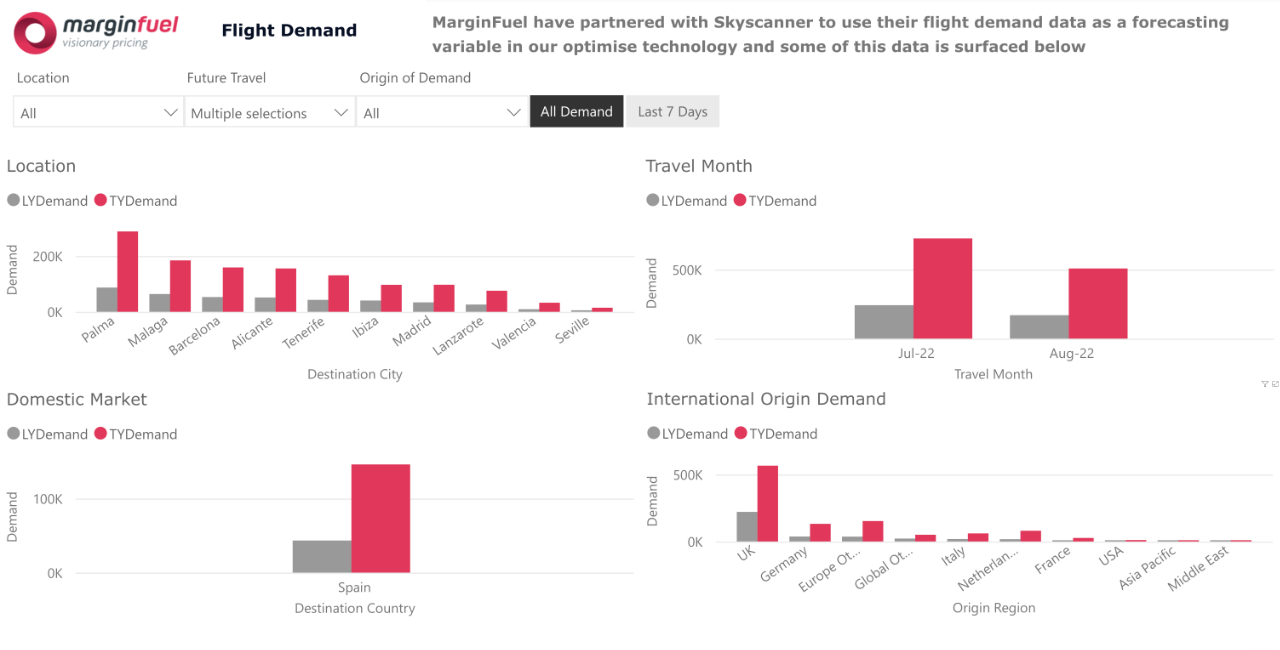

Fig. 2

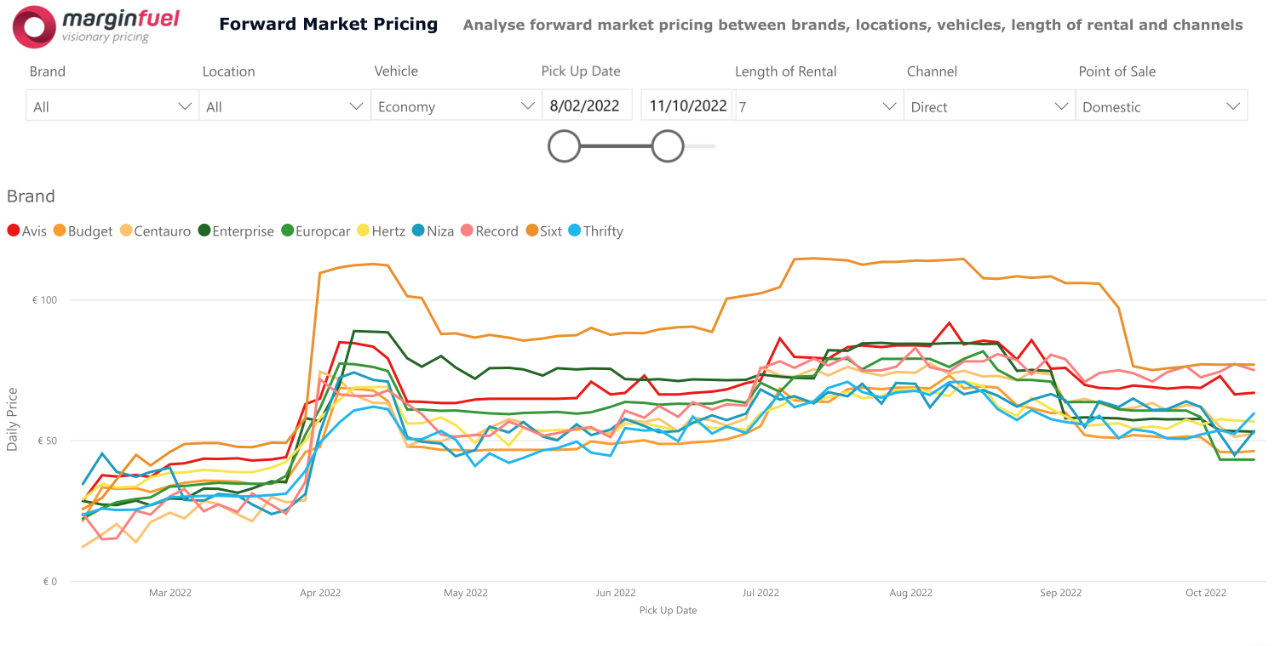

Fig. 3

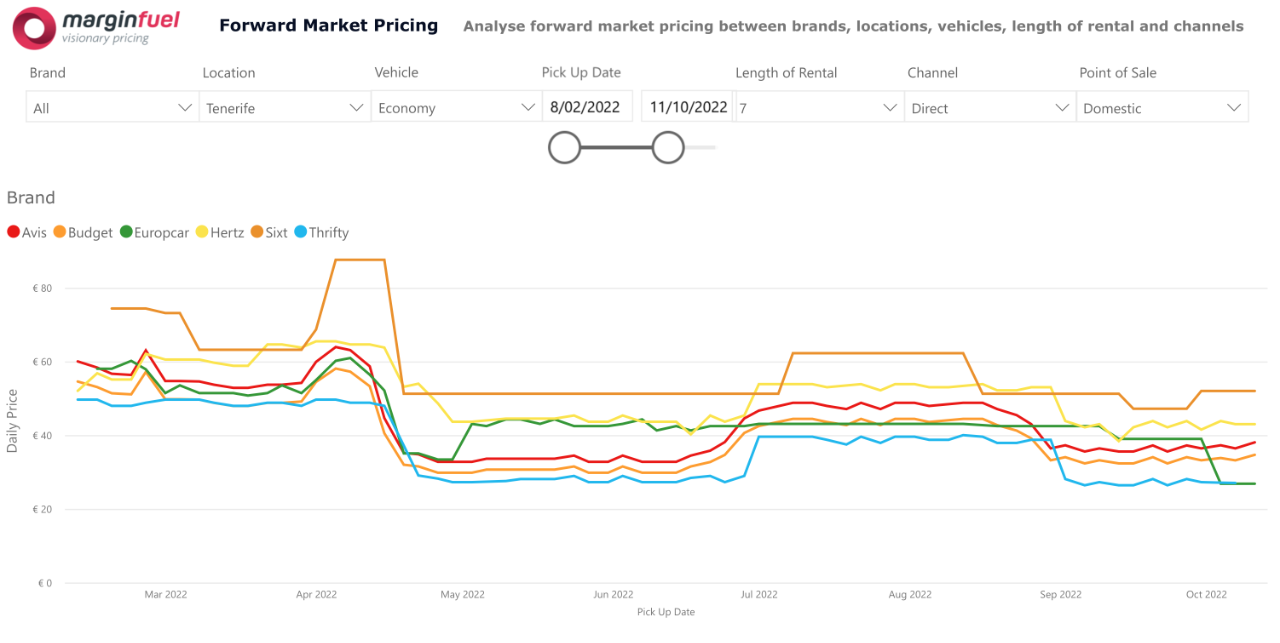

Fig. 4

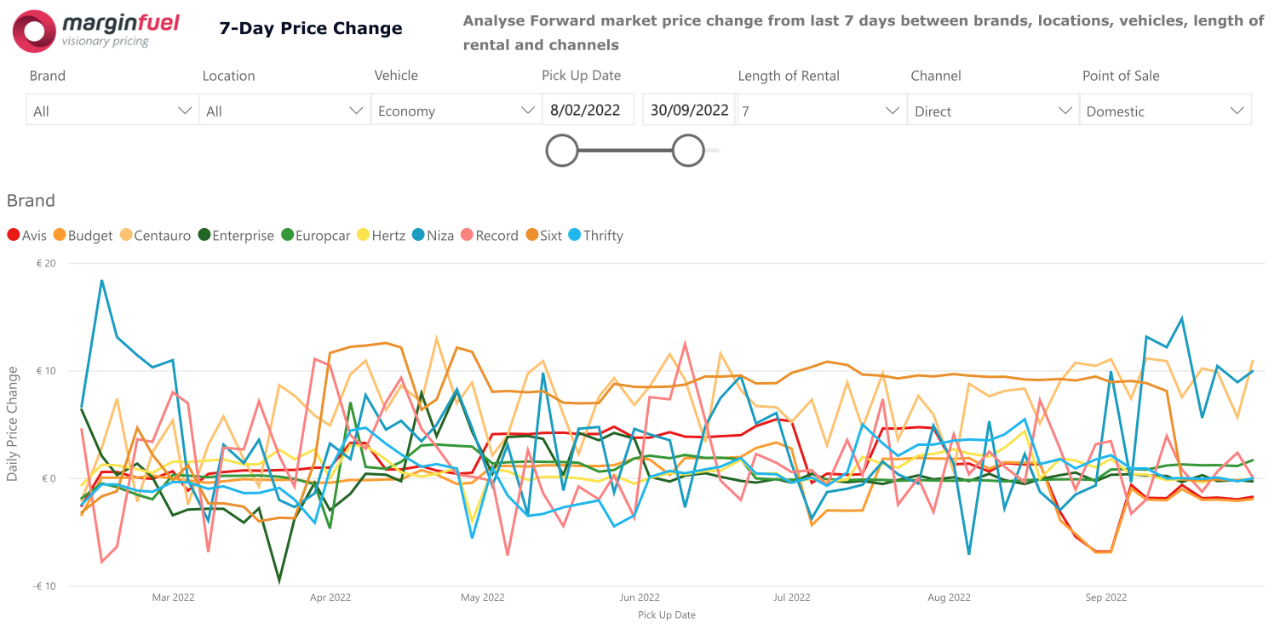

Strong focus on the next 30 days as well as the Easter holidays, where most of the price changes occurred in the last seven days. Rates have mostly come down for the next 30 days, before going up for Easter. While it is low season in February air demand is very strong, especially in Tenerife, Madrid and Barcelona. Rates are trending up in those three locations (except in Barcelona).

One anomaly is that rates have generally gone lower for July and August, which is not in line with the strong air demand. The most significant changes happened in Malaga.

Fig. 5

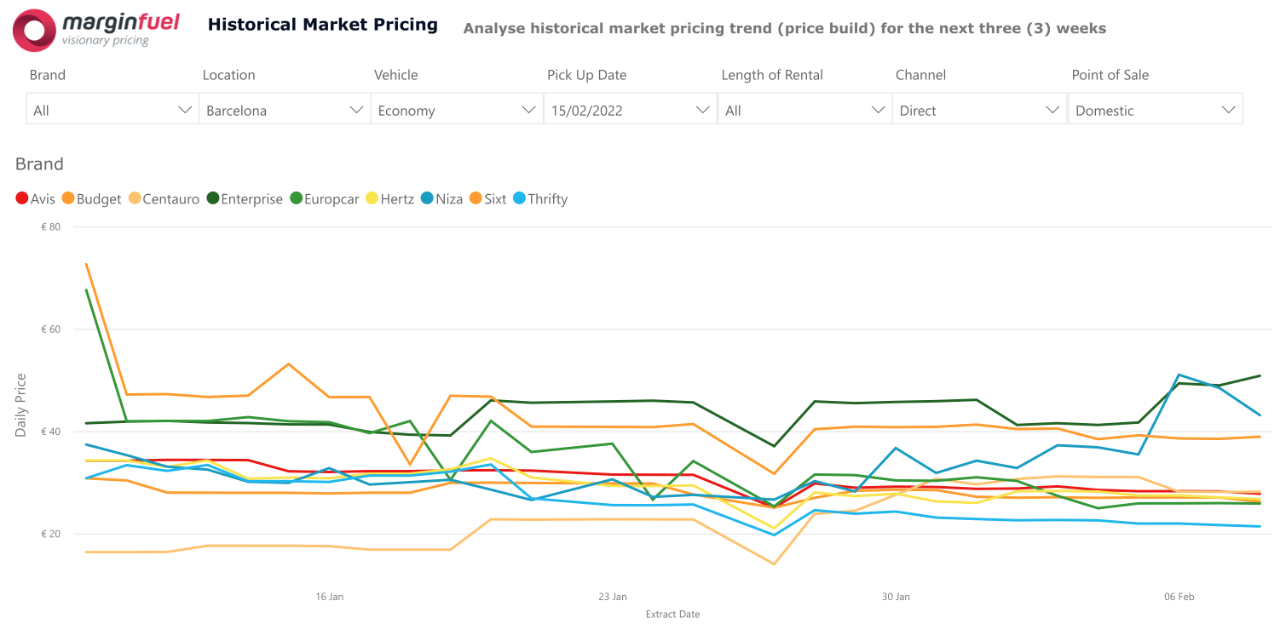

In Barcelona, rates are trending down for the Economy car for the immediate pick ups (the next two weeks). This is likely due to the larger fleet in big locations like Barcelona. Our advice: demand is unlikely to exceed supply, but air demand is trending up nonetheless – slightly lift your prices and find your sweet spot.

In Tenerife, however, rates are looking up for the rest of February. Keep yielding as there is demand.

Fig. 6

Every effort has been made to display accurate data. Users are kindly requested to advise any issues by logging a support ticket here. This is a no reply email, and every endeavour will be made to investigate and rectify issues in a timely manner. Please see footnotes and Privacy Policy for more details.

MarginFuel European Office

Nieder Kirchweg 9

65934 Frankfurt am Main

Germany

MarginFuel Americas Office

281 Belleview Blvd Unit 101

Belleair, Clearwater

Florida 33756

USA