March 2022

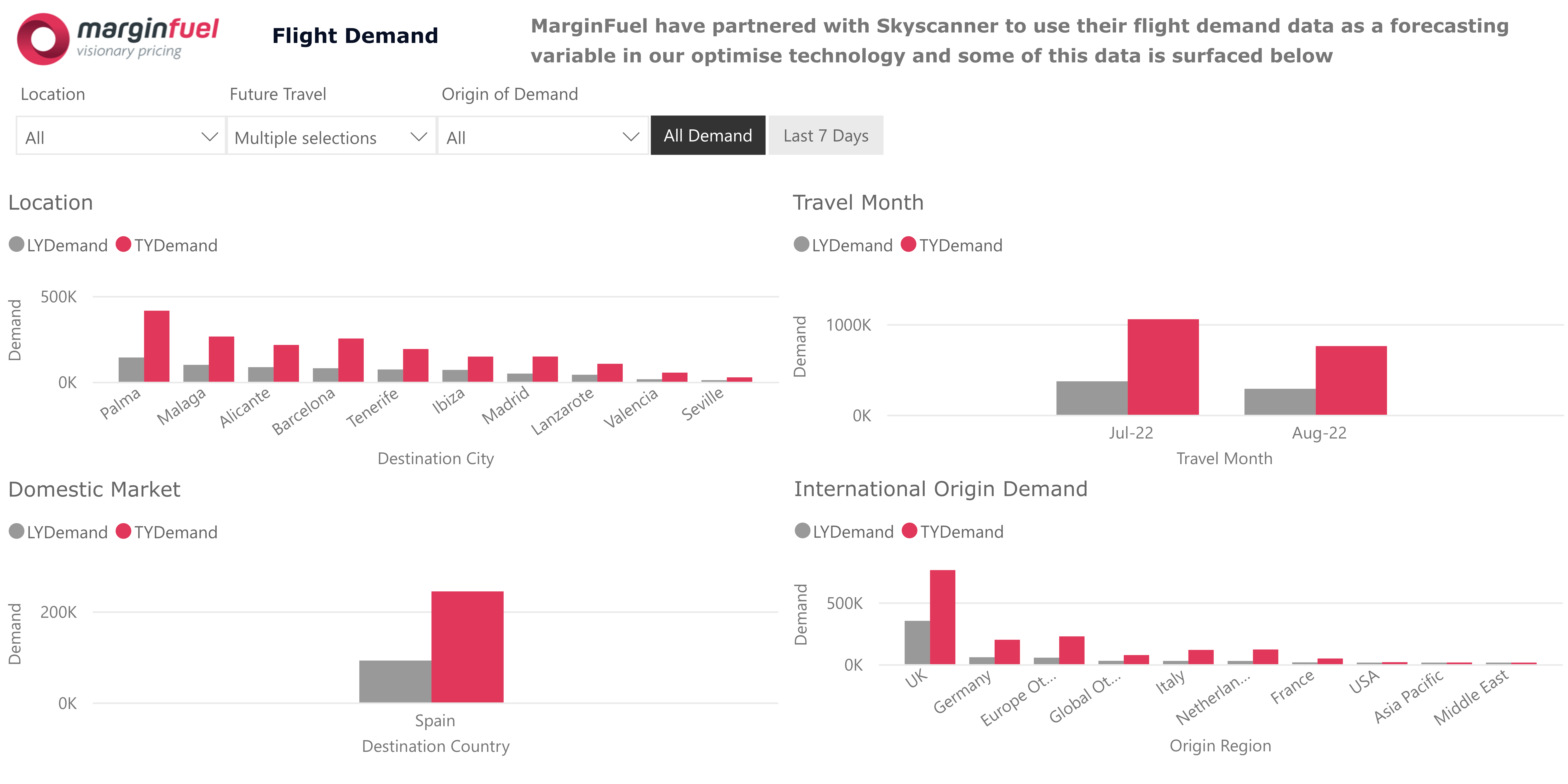

Easter holidays and summer 2022 are now the focus. Demand for Easter holidays far exceeds last years and therefore provides a great opportunity to yield.

Summer 2022 shows a very strong early demand – and as we all know, fleet will be limited so demand will outweigh capacity once again. Protect your summer by keeping your rates high and avoid selling too soon too cheap. Air demand is very strong but we are still far away from the main booking period. Rates will only go up – as you saw last year.

With limited fleet, and high demand, it will be critical to manage your fleet and channels accordingly. Make sure your fleet is at the right place and that you restrict booking coming from your less contributing and less profitable channels.

Last-minute demand remains strong as we have seen in the past year. While you should already see a nice peak for Easter in most locations, trends show that there is still plenty to come. So don’t lower your prices and try lowering your peak to avoid spillage and spoilage.

Make sure to calibrate your seasons right – especially approaching Easter. Yield the long durations that have an effect on Easter. Check your check-out dates out carefully to make sure your pricing is on point.

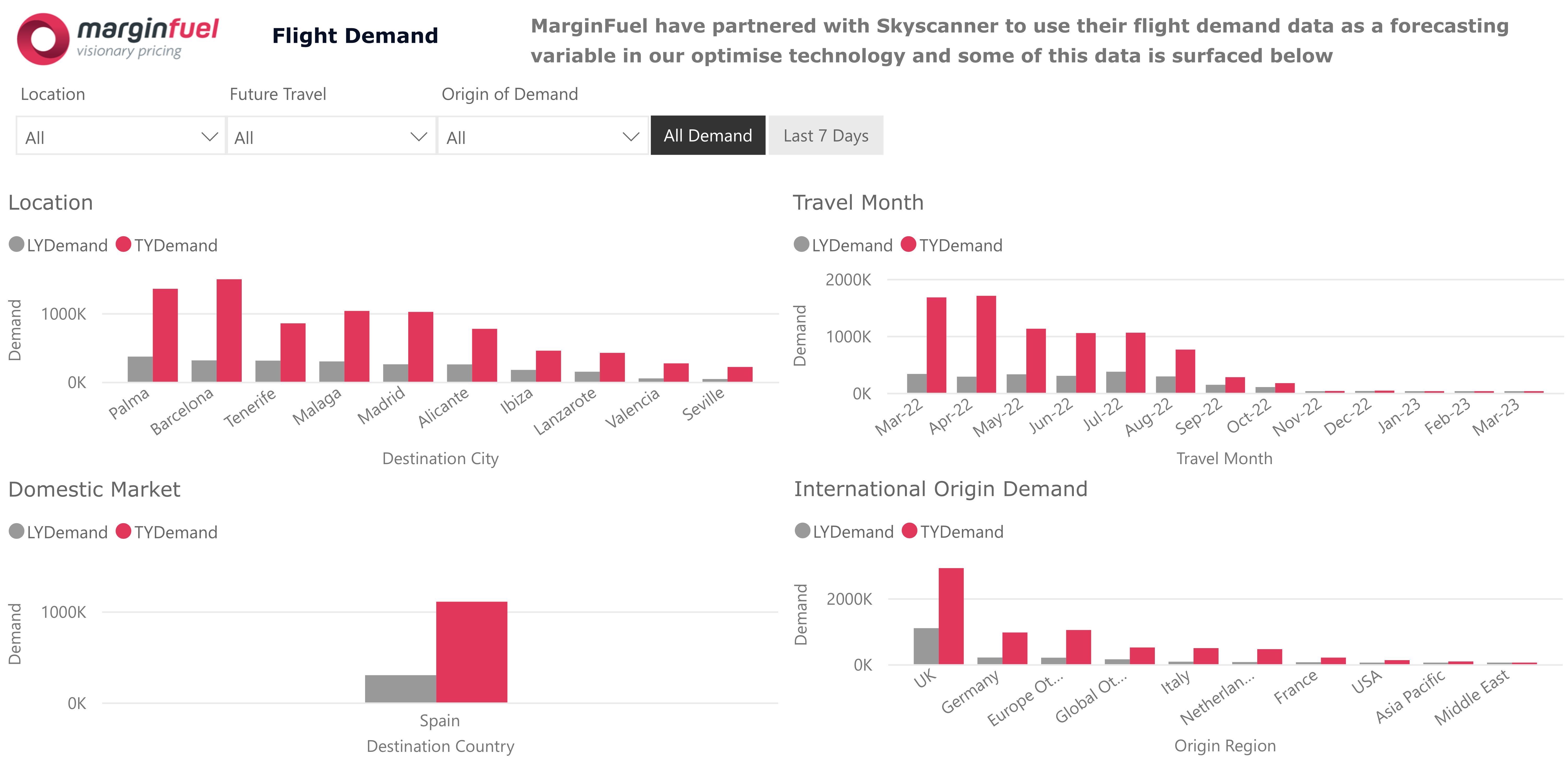

Fig. 1

The high season is upon us! Demand has greatly accelerated (it doubled) in the past month. Hot locations this for summer are: Palma, Malaga, Alicante and Barcelona, with travellers mainly coming from the UK. Palma also sees the usual demand coming from Germany, with demand currently peaking for June from this source market.

Looking at the strong summer demand and the limited fleet available, prioritise your most profitable channels and don’t hesitate to restrict others, including the brokers, to lift your RPD and add to your bottom line.

Fig. 2

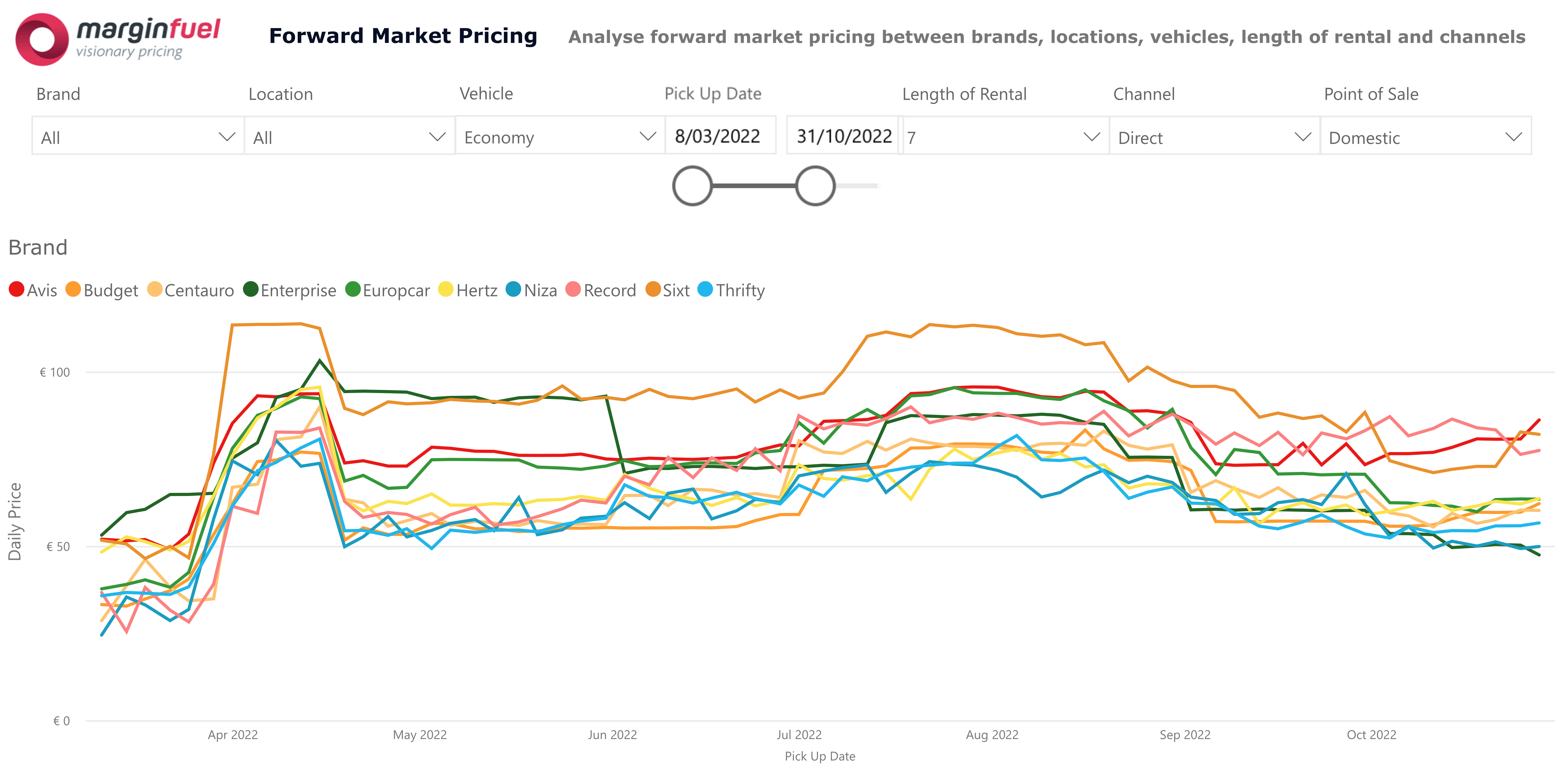

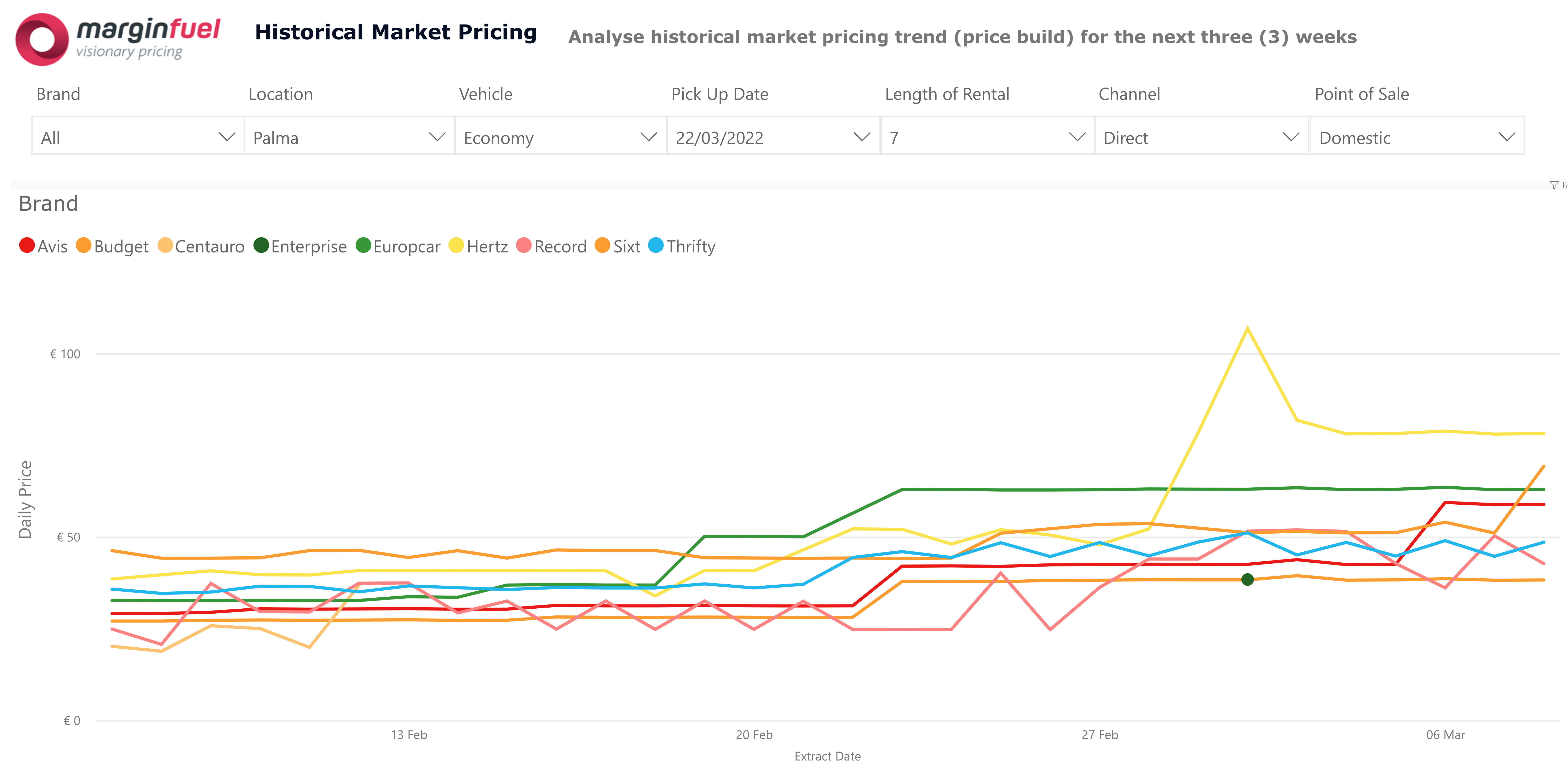

It is great to see that rates are rising for Easter as we get closer. There are opportunities to yield your 14+ day rentals in the couple of weeks preceding Easter to lower the peak.

Summer pricing is currently at the same level as Easter pricing while demand is set to exceed fleet availability. We highly recommend setting your summer pricing at the highest possible as a lot more demand will be coming and prices will go up. The more you sell too early too cheap, the more money you leave on the table!

Fig. 3

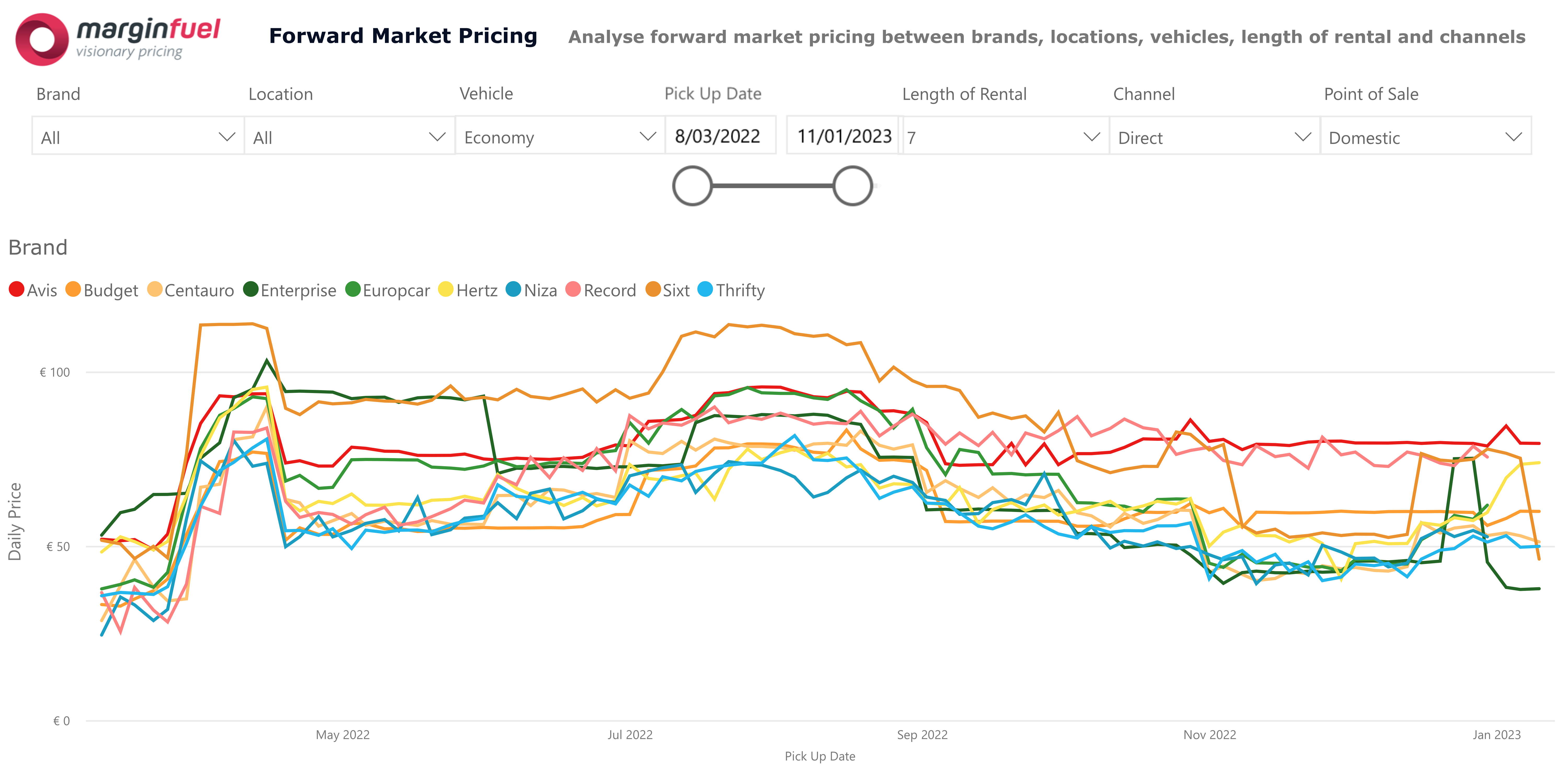

Fig. 4

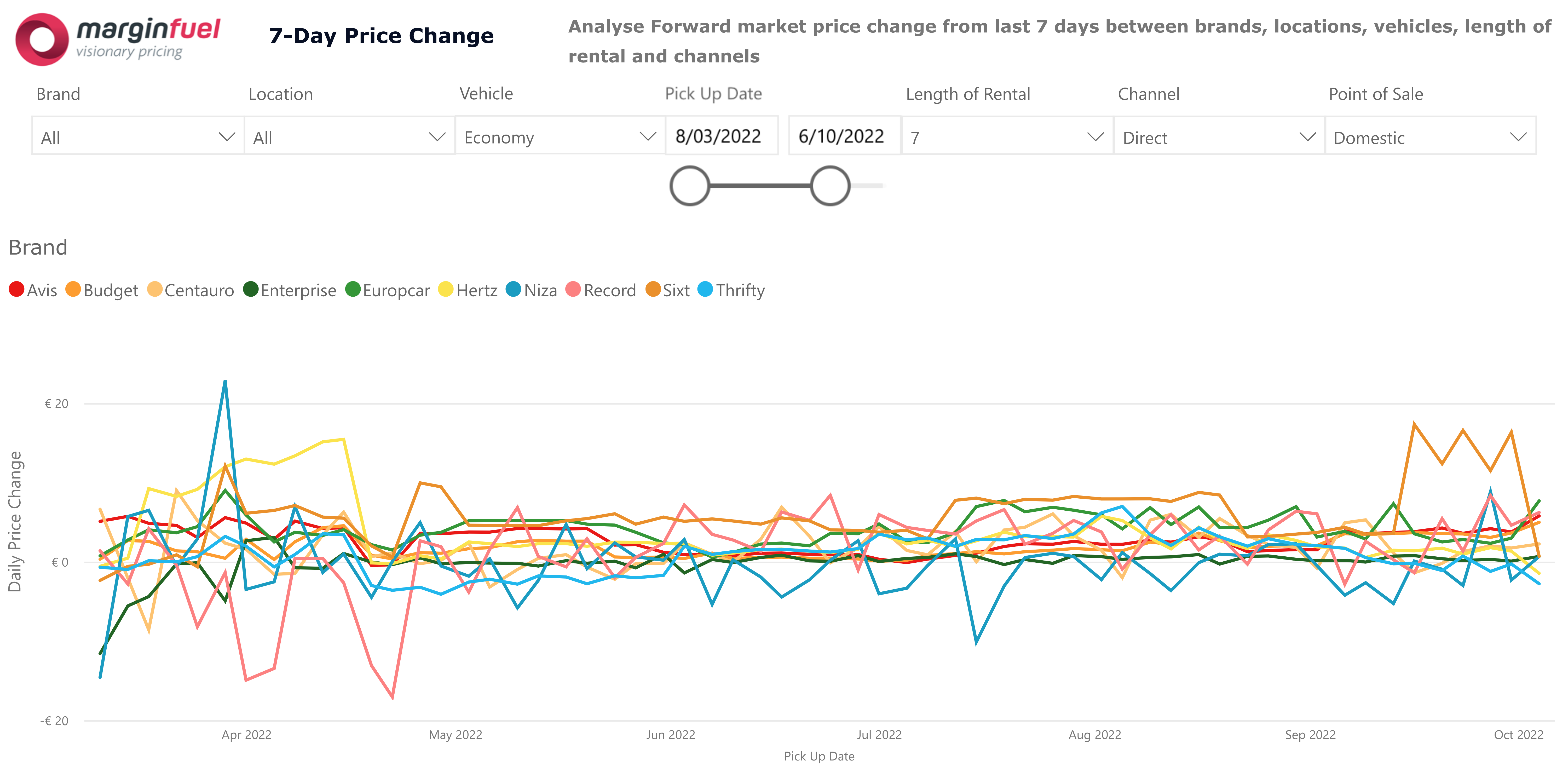

Good to see the focus shifting from the next 30 days to the next 5 months – covering summer. We notice far less negative price changes, meaning everyone’s rates are trending up. This is very positive and is aligned with the air demand.

We still notice some rates moving down for Summer, however, especially in Malaga. Air demand is very strong and with limited fleet, keep your position and your rates up for the best revenue outcome.

Fig. 5

Rates are generally trending up which is great to see. There are some significant movements this week for end of March from some operators. While it is great to see that rates are going up, significant changes may indicate a sudden surge in demand. What that means is that your prices were too cheap before end. Keep a close eye on it and overlay with your utilisation data.

Learning from previous years (albeit challenging nowadays) can help you navigate this. Or talk to us to hear about how we can help!

Fig. 6

Every effort has been made to display accurate data. Users are kindly requested to advise any issues by logging a support ticket here. This is a no reply email, and every endeavour will be made to investigate and rectify issues in a timely manner. Please see footnotes and Privacy Policy for more details.

MarginFuel European Office

Nieder Kirchweg 9

65934 Frankfurt am Main

Germany

MarginFuel Americas Office

281 Belleview Blvd Unit 101

Belleair, Clearwater

Florida 33756

USA